From today’s WSJ.

Pretty good write up on the game - but I think they grossly undersold the value of things overall.

Which is fine by me, really.

Less players, or less talking about the full picture - less chance the banks shift the goalposts. ![]()

I think making their charts show the fee vs direct rewards annually without talking about bonuses makes it look like people are putting in dozens of hours for their cards to make back a few thousand $ in value - when in reality the combination of annual card rewards and bonuses and free night certs, yadda yadda yadda is really a much larger win.

I mean, above in the thread I shared that my past trips over the last 2+ years have provided about $23K NET value in travel so far, plus I still have almost 3 million various points in the bank worth a median $36k to spend. And, we haven’t hit too many bonuses this year at all!

Small Win Alert

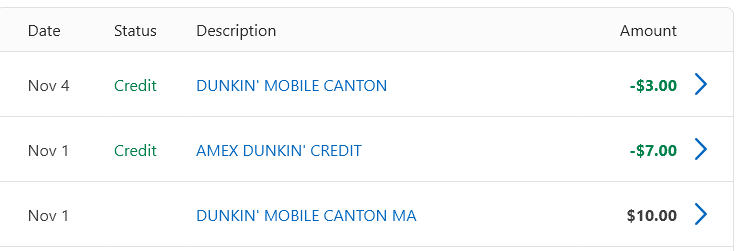

Any Amex Gold card holders: recently they added a Dunkin offer for spend $10 get $3 back up to 3 times.

When I reloaded my Dunkin gift card this month, instead of the usual $7 to get the monthly perk I tried the full $10. (I let my DS use these, he goes there for breaks from work.)

Terms on that offer above say that card reloads do NOT work - but, in fact, dear readers: they do.

Welp, I got denied the Ink Business Unlimited. Do I call now or wait a few days?

You were denied online immediately?

I’d probably wait for the letter with reasons - even though they are usually entirely fiction, that way you can discuss them with the recon person.

I was denied for my SW Biz card, reasons it listed were irrelevant as when I called in turned out they thought I was over 5/24 and told me so. But, they were counting an AU card from my DW, so she pushed it through again. A week later and I still have not heard back on that one so think I’m going to be needing to make another recon call.

They do seem to be stingy lately.

Gah! Got bit by the authorized user on the 5/24. I’ve actually got six accounts listed on my TransUnion within 24 months.

I recall a discussion a little while back to no longer add P2 as an authorized user, and I’ll be following that moving forward.

Recently I learned a nuance of AU card dates: I guess I probably should have known this could be the case, but logically it never occurred to me:

If you add someone as an AU - that added date is what is used on the credit report, NOT the original open date.

My DW’s Gold card is ancient, something like 25 years. I was an AU on it from back then when we were first married, but I took myself off when starting the points game for some reason I can’t recall. So, when I had her add me back as an AU to it last year, I didn’t think it would factor in 5/24 at all since the card is so old.

Learn something new every day, I guess.

Oh also, if you really needed to or just wanted to avoid having to call recon because of AU cards counting: it is possible to remove yourself as an AU on an account then ask the credit bureaus to remove the card from your report since it was not your responsibility.

There are differing reports online of that tactic working - but I tried it for one card a couple of years ago and it just a few weeks for them to get it done.

I may have written it up here in the thread then, but I’m not sure.

I figured that would be the case, and with the Ink bonus dying next week, just going to wait at this point. DW desperately needs a UR earning card though, so need to check into her 5/24.

There a very good Ink offer 90k points with no yearly fee. Thinking DH will pick this one up this week. Business doesn’t count on the 5/24. $6000 in 3 months. Since I have a 2027 cruise I can throw a chunk on, we will spend what we can’t then pay the remained of the spend on the cruise. First fund plan is to pay for the cruise with my Christmas Bonus anyways. So timing works out.

What’s the easiest way to lock and unlock your credit? I’m concerned my lap top may or may not be hacked. Weird things open up when no one is using the computer. But today Turbo Tax was up and some other concerning pages.

I’ve googled it and found some people say that happens with Microsoft Egde. But I’m not convinced.

I lock/unlock in a browser, but I believe each site has a mobile app. I’ve only used the Experian mobile app and it is pretty easy to use.

For your laptop concerns: I’d suggest you download Malwarebytes - you can get the free download version and do a full system scan. It is good at finding stuff and helping remove it.

Thank you! I thought I had a Malware scanner. When I go into the security settings, everything is fine. Additionally, the accessibility setting were magnifying to an obnoxious level.

I called Lifelock and they advised to go online and lock our credit reports. I had been meaning to. I’ve read a few people keep them locked and only lift them temporarily when needed. I think that’s what we will do.

Thank you for the quick response. Will check my laptop asap. And remind DH and myself to shut it down after each use.

Nothing found. So that’s good. Doesn’t mean total security but I’ll wait till tomorrow to deal with the credit reports at least. Lifelock sends us emails when our credit report has an inquiry. So I will also keep monitoring for that. Thank you for the resource!

Absolutely keep those reports locked down! It is easy to freeze and unfreeze, and these days everyone’s should be frozen my default. ![]()

Placing this reply here for reference later - a positive data point from Enchantedbythemouse on this tactic working. ![]()

Background:

A week or so after I originally posted about this possible tactic I read about in the 10xTravel FB group that turns expiring Southwest travel credits into NON-expiring, I went back to see if there were any new data points in the thread.

But: thread was gone!

(or FB search was being stoopid, but I don’t think so now.)

My two thoughts were

- Even though there were a few positive data points in the comments it eventually turned out not to work, or at least work consistently.

- OR the FB group mods thought the info was TOO good and removed the post to minimize the chance of SW catching on if it got around.

I dunno.

But: keep this knowledge in your back pocket for later, folks. Hopefully it continues to work.

Is the key to this booking choice preferred class, or using a gift card as partial payment, or are both necessary?

It is both.

If you click up to my original post there’s a rundown.

I want to downgrade my SW Business card from Performance to Premiere. We are going to want to book extra leg room from the get go. Boarding A1-15 was a sweet perk. But that doesn’t even matter now. Also canceling my personal card. I’ll get it back though probably next year.

its not a huge deal but, if I wait for the yearly fee to hit and then call to downgrade, will the credit the difference in the yearly fee? Or should I do it before? It would be my third year so I don’t need to worry about SUB points.