This summer I decided to finally take the credit card rewards and points game seriously, so have been learnin’ up on all sorts of credit, travel, and other tactics.

I thought it might be time to start posting some info I’ve found useful.

Way back in 2017 I wrote in excruciating detail about some Disney Visa and Barclay Arrival tactics I was using for a trip back then.

I did very well: I turned what should have been a $3700 WDW trip into about $1,000 out of pocket.

But since then, I only kind of sort of half-assed using rewards.

This year I started working towards the full-ass.

By the Spring, we had about 7,000 Amex Rewards from general spend on my wife’s ancient Amex gold card from circa 1998. That, it turns out, had TERRIBLE rewards.

So, I ramped up things using tactics from commute time binge listening to the Frequent Miler podcasts all the way back to episode 1. Also read through many of the usual sources: The Points Guy, Doctor of Credit, Danny the Deal Guru et al.

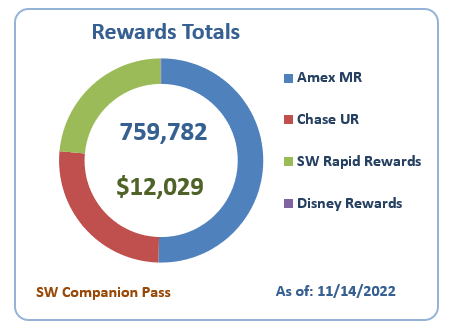

By the time we get to early January, I expect to have somewhere in the neighborhood of 760K points in a couple of different programs, plus a Southwest Companion Pass. And about $700 in Disney Rewards. (That last one is over time and not accelerated this year.)

We’ve already taken advantage of some nice travel perks using my Amex Platinum and Chase Sapphire Preferred, including a stay at The Lodge at Spruce Peak which, after taking into account annual travel credits, dining credits et al cost us about $100 for what should have been a $600 stay.

(And I’m not including the value of the suite upgrade we received to an upper mountain view with fireplace and balcony, or late check out time.)

My ̶e̶v̶i̶l̶ grand plan is to put together enough points for us to be able to take more quick aspirational domestic trips, as well as larger ones back to WDW. Also, I hope to take some even larger ones over to Ireland and Czech Republic to visit the old family towns and cousins I haven’t seen in a long time.

I’ll add some updates below… but first… visit the second post below for NEW SPREADSHEET TIME.