@JJT - is there any downside that you can think of in transferring all of my points from my Chase Freedom Unlimited to my Chase Sapphire Preferred?? I don’t think there is, but maybe you know something that I dont.

No issue there - that’s actually the recommended thing to do!

The Sapphire card is the one that opens up transfer to partners, and if you ever wanted to use the points in the portal using the points on the Sapphire gets you a value of 1.25 cents/points.

(I’m sure you know: booking with points through the portal is NOT a good return on points, but throwing it in here for others reading this later. You can easily get 3+ cents per point at airline and hotel partners, like Hyatt.)

I move all the points from both my cards and my wife’s over to my Sapphire every month.

Thank you for confirming! I just learned about the transfer - and haven’t done it yet. I love being able to use the Unlimited for 1.5x points and then transfer over. We’ve got some flights coming up in the next year or so, and these points will help tremendously!

So I recently got the Sapphire Preferred and just met my spending bonus. We will have 80k points (plus the extra points from purchases) available next week. We are wanting to use these to book flights through Southwest. What do you recommended is the best way to do this?

You can transfer your points from Chase to your SW account in 1,000 point increments. I only transfer as much as I will need to book my flights. The transfers from Chase to SW, in my experience, happen almost instantly.

Transferring to partners is very easy in the Chase UR portal.

Only things I would suggest is that I would not just transfer all my points over to SW or any partner unless I had a specific use for them. You don’t want them stuck at a partner, then find you needed points for something else later.

In most cases I’d just watch SW for a deal or at least decent redemption, then transfer the points then to book the flights. (If you really want a lot of SW points, wait until fall and do the 2 SW card (biz + personal) deal to earn a companion pass - I earned mine last year and have 166,500 SW points to play with now. I’m using most of my Chase points at Hyatts.)

Using the points at SW will get you a standard 1.25 cents/point in value - which is a bare minimum as compared to, say, transferring to Hyatt where you might get 3 cents/point or better depending on the deal and location.

BUT, if that’s the best redemption for your plans, I wouldn’t worry too much about that - I personally just threw a bunch of Chase points at Marriott to fill out a week I’m booking with certificates, and that only got me 0.87 cents per point. ![]()

Thank you!! This is very helpful! Yes we will be looking to add southwest cards in the future. We just got into the credit card game about 2 years ago. We had to start with a basic bank card because of our limited credit history. We then added on a Delta Amex last summer when we booked international flights and got 100k points. Now we got the CSP which is our first good cc. We chose this one over SW since it has no international fees.

Quick update - I’ve updated the sheet to add some needed columns to track actual cash back saved etc - plus added a tab where you can copy used/expired deals to keep track of them over time, but make the active sheet cleaner to look at.

I keep a link to the sheet on my Android phone’s desktop so I can open it quickly when at stores, because it can be hard to keep track of multiple card offers!

You can use the original link above to access it.

Thanks! Good to know!

@JJT - It seems like my top two card options are the Capital One Venture Rewards or the Chase Sapphire Preferred. It sounds like you favor the Chase Sapphire Preferred. Sign up is better with Capital One but sounds like it might be easier to “hack” with the Chase one?

Also, is it better to sign up now or wait for a special sign up deal? I didn’t know how often stuff like that occurs.

Another question, if one of us signs up, how long do we have to wait before doing the whole referral thing?

I haven’t really looked at the Cap One cards at all yet, but I do know they have some good ones in the Venture cards and I’ll hop over there one day. But, since Chase has the 5/24 rule I (and many others) want to take advantage of all the personal and biz cards over there as long as possible.

If you get the Sapphire (times 2 if playing with spouse) then Ink cards (3 of those) alone and you really can rack up a lot of points.

If you visit places that have Hyatts, transferring those Chase points can be a gold mine.

As to referral timing - once you get your card you can probably generate a referral link fairly quickly. I think last time I did it with a new card it was only a day or two.

You can use the generic refer-a-friend page to enter you info and see if you can generate links:

Thanks @JJT!

We are definitely both going to do a card. Thinking we’ll go with the Chase, like the transfer options. Unsure if I’m ready to dig into the business cards but I’m definitely tempted

This is a small win in the grand scheme of points things, and I am probably slow on the uptake on this one but throwing it out there in case anyone finds it useful.

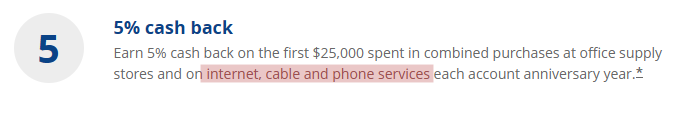

Apparently Netflix codes as “cable” to Chase, so if you have a Chase Ink Cash card you get 5x points on it.

I think I knew this before but forgot? so. much. to remember.

I am planning on doing the Chase Sapphire Preferred Card. Does anyone want to send me a referral link to get themselves some points?

@JJT - I have been reading about the Business Credit Cards on 10xTravel. Considering it. Do you own a business or are you applying under your name?

I’ll DM you one! ![]()

Sure - I apply for business cards as a sole proprietor, so use my own name and Social Security number on the business application. I keep the 10x reference page open when applying to make sure I use the format they outline.

Since I write for TP, I use that as my sole prop business type, but I also IT consult from time to time so would use that if I didn’t.

Even something like selling things on FB marketplace, Etsy, or even yard sales or one-off items count as businesses. I believe the Frequent Miler podcast guys even describe the credit card company criteria as the intent to start a business as working.

Okay cool. I sell a few things on Ebay but was unsure how much I should put for profit since it would be minor.

Are there ever audits for this kinda stuff? Selling in FB/Etsy would have a paper trail, stuff sold at a yard sale wouldn’t necessarily have any documentation