This is kind of what I was thinking about. I’ve got the referral bonus from DW, and have a friend that might sign up. The book then cancel seems dirty, but….

What are the dates you’re using for that?

I do know of people that do this as their main tactic - get the card, book something large to earn the CP ASAP in the current month (of course, will take until statement close to show up) - then take their time completing the full spend over the next 3 months.

I don’t think it is really a dirty tactic as this kind of thing happens in real life anyway - and you still need to spend your SUB requirement amount, you can just be more leisurely about it. ![]()

click the link in previous response where I say “Here is one in Orlando…” to open the same search. I believe it is 1/6-1/11/25?

The results page can be a little squirrelly, I saw a “Celebration Suites” for 17K points I was going to use as the example, but then I refreshed the page, the bonus for that hotel went away.

We hit the SUB last month. I wasn’t eyeing CP, so kind of dropped the ball, but we needed the points for march travel. Urgency vs long term vision bit me!

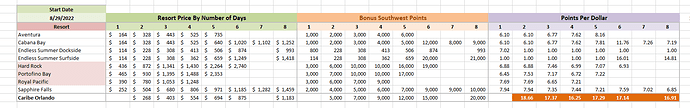

I ran an analysis spreadsheet on these SW package bonuses back in 2022.

If one was already planning to book a particular hotel I think you can really earn some crazy points per dollar even when the room prices are comparable to other discounts.

Back then the Caribe Orlando was by far the winner at up to 18 points per dollar. The Hard Rock at that time was offering 19K points for the same spend you are using now, so 41K bonus probably equates to almost 14 points per dollar?

Sounds plausible. How long do you reckon I’ll have to keep this booking before canceling? Interest accrual?

Oh, I would not pay any interest - let it hit the statement and season there for awhile, then when the statement it is on closes you can probably cancel well before the monthly payment for it is due.

Within several days of the statement close you should see the points on your acct I believe, then likely a day or three for the CP to kick in(?)

I think my statement closes today ![]()

Maybe you’ll get lucky and it jumps out of pending immediately! ![]()

But, might be a moot point (no pun intended):

As I was just driving I had a recollection reading that these SW hotel portal points may not appear under the same rules as earned spend points though - so I just Googled a little and if this reddit thread info is correct, you might see the points in just 3-5 days or a week at the outside.

Then the CP should be pretty quick to show up. Fingers crossed!

Similar info here too:

That’s a relief, as I just got done making a reservation for myself and DW. I came across this disclaimer, but I think it might be targeted at another points earning schedme.

@JJT Noticed this line on the receipt, and went and reread your posted links. They all seem to indicate that the points will hit AFTER the stay is complete.

On a prepay, they reported this in the first link:

“IME, if it’s a prepaid reservation, the points post within 3-4 days of checkout. And then once you have 135K CP qualifying points earned in a calendar year, the CP is in your account immediately.”

I guess I’m reading this as 3-4 days of checkout from the hotel, not checkout for booking the reservation. I’m never checking in, so won’t be checking out ![]()

Ahh, I suppose I’m reading checkout incorrectly. Sorry if that’s the case.

If so, your only option will be a referral or some serious refundable spend all at once.

| A reminder to people booking travel: Don’t forget to garden your reservations! |

|

Things happen, dealing with them before you get there is infinitely better.

- Prices change (whether points or cash bookings)

- Portal bookings (if you dare) don’t always make it to the hotel/car rental/airline

- Bookings that you made and checked can mysteriously disappear

- We all make mistakes: make sure you didn’t book a room in 2025 when you meant 2024!

I’m not a fan of getting a lot of newsletter and sales type email, but if I have active bookings going on or am hoping for a deal to show up, I make sure I have communications turned on for those companies. (Usually Southwest, National Car, Hilton, Marriott, Hyatt.)

That helps remind me to check my stuff every once in awhile and I might get some new codes to try out.

If I don’t actually want to read them all I set up a filter that just deletes them or archives them (depending on how long I want to keep them.) That way if I need to I can go back in my email and look for codes I wouldn’t have otherwise received, but not be bothered by reading/deleting them all the time.

|

My recent gardening expedition just earned me another discount for an upcoming National car rental - my same reservation has dropped almost $60 in total since I first booked it. Today I only gained another $4, but FREE COFFEE BABYYyyyy. |

I’m thinking of getting an Amex card, mainly to attach to my Rakuten account. I’m not looking to completely jump into the Amex world yet, so I’m looking for a card with no annual fee. Thinking maybe a business card would be a good idea so it does not add to my card count. Is it harder to get a business Amex card than Chase? Any card suggestions?

In my experience, Amex seems to have a giant candy jar full of business cards they are trying to give away like my Irish Gran at Christmas. ![]()

![]()

![]()

Of course, all of the bank algorithms are mysterioso, but BBP seems easy to get - they gave me TWO in the course of 9 months last year.

The Blue Business Plus is a no-brainer in this instance - no annual fee, respectable 2x MR on all spend (up to $50K/year) and a 0% no interest for 12 months, so you can play the float game if you want to and keep earning interest on your cash. (If you do this you have to pay minimums each month, of course, then pay it all off at the end.)

The usual SUB on the BBPlus is only 15K, but sometimes you can catch a 50K sub with a 12 month spend window. The spend requirement might be high for that one, but in my experience is good to have a card with a long spend window so you can fill in gaps when you don’t have other cards you are working on. (I wrote a few posts on this card way back in the thread.)

Lately referral bonuses on Amex account links have been a little puny (for me at least), but don’t forget to use a friend or family’s link if you can to give them a boost!

Or - Alternative Rationalization Universe answer:

There are some terrific Amex Biz Gold offers out there for 175K for $10k spend, or 200K for $15K spend. I just had a targeted mailer for the 175K and opened one. (Thanks college tuition!)

The Biz Gold does have an $325 annual fee, but you also get $20/month statement credit that you can use at a few places. The truly easy one is office supply: you can just buy a $20 gift card online at Staples each month for somewhere you normally spend money. (We do Chipotle and Sbux.)

So, that essentially makes the net annual fee $85 and you’d be getting points worth $1850 at worst and over $3K at best.

It also earns 4x MR at top 2 categories (Transit, gas, restaurants the most likely uses for most of us) plus a Walmart+ monthly credit.

If you went for the Biz gold, you could go for the BBPlus next year and close the Gold after the year is up. ![]()