Thanks for the input! We’ll be sure to charge everything to the room. My husband thought it was funny because the Disney rep he talked to was trying to figure out how it would code, and she said that Disney vacations are super expensive. He didn’t expect someone from Disney to admit that ![]()

FWIW, AwardWallet has a lookup tool for merchant categories, but in practice I haven’t found it very useful.

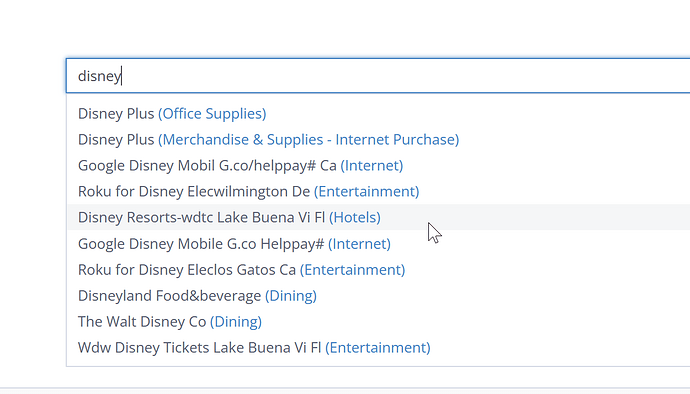

For example, when you type in Disney, you get these options - which really doesn’t clarify what’s going to happen when you pay for your resort stay, IMHO. But, might be a little helpful with some merchants.

Usually get better and more up to date info in Disney forums or points FB groups.

Anyone playing the Amex Membership Rewards game, might want to check your referral links if you haven’t lately. My wife’s Gold card always seems to have increased referrals bonuses compared to mine. Hers has been at 30K for awhile, while my referral links have been stuck at 10K or 20K.

But, today I noticed the sign up bonus I’d earn using her link to get a new Gold myself has jumped up to 90K MR PLUS $200 back - so essentially making the first year’s annual fee $50.

The 90K rewards is conservatively worth $1,395 on its own, plus the Gold card has a $120 dining credit ($10 per month, which may or not be valuable to you because limited selection of places to use it), and a $120 Uber credit (again $10/month, BUT you can use it for Uber eats very easily in many places.)

And, that doesn’t even include 4x points on restaurants and Groceries, which adds up super quickly in our house. (Since this will be our 3rd Gold in the house, that part won’t be too useful on a new card for me.)

So, for me this one’s going to be a pretty big money maker for me. ![]()

![]()

![]()

BTW: the person generating the referral link should double check their offer in the dashboard - our links do not have this added bonus, but some links ALSO get the referrer an addition 5X rewards ON TOP OF the 4X at supermarkets for 3 months!

That is freaking huge.

This capture isn’t mine, is from someone’s blog post - but pasting here for reference.

Everything that was charged to my room was coded as travel. My chase sapphire got 2x points on that.

However, sometimes I would use my physical card at a restaurant or quick service because then it got coded as restaurant and got 3x points.

I was thinking about getting a Capital One Venture X card to help finance a WDW trip next January using statement credits. I know that to do that the statement needs to code the purchases as “travel.” I just noticed, though, that booking a Disneyland trip through a travel agent last month, the whole package coded as “lodging.”

I actually drove down and only used the travel agent for lodging and tickets, is that why?

I’m super new to this, so advice is appreciated.

From what I’ve heard and experienced, packages in WDW code as travel - and a good tactic to maximize is to charge all merchandise and dining purchases back to your room so they all go through as travel.

I am unsure if Disneyland is somehow different?

Maybe someone else with experience there can chime in.

Driving vs flying should have no bearing on how things code.

The code you is tied to how a particular vendor is set up in the system - perhaps your payment was to the the TA (who then paid on your behalf?) and the TA somehow has their business set up as “lodging?”

That seems very unlikely to me, though.

(I’m assuming your package included a Disney-owned hotel and not a 3rd party hotel + Disney tickets.)

Great question. It was a Disney “good neighbor” hotel that was booked through my travel agent, but was an official Disney package. In other words, I could’ve booked the same package directly through Disney travel if I’d known what to ask for.

Also, my travel agent, who was great, is actually with TouringPlans.

I’m going to guess it was the combo of 3rd party hotel that did it then - but coding is generally a mystery and very inconsistent. Usually have to rely on other people reporting back on how various stores and locations code. (For example, Undercover Tourist is good to buy tickets as they code as travel.)

AwardWallet has a merchant code lookup tool for doing research - but IMHO it really doesn’t help much.

For example, I looked up the DL good neighbor hotels and tried out a few. Most say they are “Hotels” - which I assume translates to “lodging”, but then again many WDW hotels show up as “Hotels” too.

And, if you try Anaheim Marriott it shows up as both Hotels and Travel. ![]()

Touringplans themselves shows up as Travel (twice.)

Hey, thanks for the info. I appreciate it. Using that tool and looking up my hotel, Grand Legacy At The Park, it shows up as “hotel.”

Sounds like it’s a bit of a toss-up.

I would call the credit card company and argue that lodging is a subcategory of travel… But being a new customer, you cant really ask for the customer loyalty or customer retention department…

LUCRATIVE CREDIT HACK ALERT

key word OR. Don’t get greedy.

Is there a good “cross reference” of OLDER cards rewards vs new?

Like I got an offer from Citi to change my current Citi Thankyou Preferred MC to a “newer” one that earns points differently. And one of my Wells Fargo cards is also prompting me to switch to a new card. And I’m trying to figure out the differences and if it would be better to switch cards

If I can’t have the M&M’s and the Dew, it’s a deal breaker!!

I honestly didn’t know Sears was even still in business… ![]()

I have a 20 year old Sears credit card ![]() My Gramps used to tell me that the Sears Card in his day was up there with today’s Amex Platinum. I did just get a nice 0% for 3 years balance transfer with only a 0.99% transfer fee. So I bought a used car

My Gramps used to tell me that the Sears Card in his day was up there with today’s Amex Platinum. I did just get a nice 0% for 3 years balance transfer with only a 0.99% transfer fee. So I bought a used car ![]() Then transferred the balance. Better than the 2.9% offered for financing and Savings is currently getting 3.5% so keeping up with inflation…

Then transferred the balance. Better than the 2.9% offered for financing and Savings is currently getting 3.5% so keeping up with inflation…

Edit: Actually not sure about the keeping up with inflation part but better than what I’m paying in cc interest had I taken the $$ out of savings, lol

First (See the BUT below this): Usually for any decision I’ll just create a simple spreadsheet that lists the cost and benefits side by side.

Then I’ll try to estimate how many points I’d earn with each.

Say if the card you have now gets 1x points at grocery and 2x at gas, but the new one gets 2x on both I’ll guesstimate how much I spend on each category in a month and year, then figure out how many points I’ll end up with. Then compare the annual fees and see if you think the points are worth it.

Disney Visa keeps sending me offers to upgrade my basic card to the Premier - which has a $49 annual fee. They offer no extra points for the upgrade, just the 2x points I’ll get on some category spend. In reality, when I crunch the numbers I’d have to spend more than $5,000 in those particular categories to even earn back the annual fee in rewards points. Not worth it.

THE BUT:

In general, the biggest way to earn a lot of points is through sign up bonuses (SUBs.) So, you want to check out the rules on how/when you can earn a SUB and if taking an upgrade offer will make you ineligible for those.

I don’t know Citi rules as I haven’t looked into any of their cards yet, so you’ll have to Google them. Usually sites like Frequent Miler and The Points Guy have great rundowns of tactics on each card type.

But for example, with Amex: for most cards they have “once in a lifetime” rules for earning a SUB on a card**.

So, Say you have a Gold card and they offer you a bonus of say, 60,000 Membership Rewards to upgrade to Platinum - if you take it you will be ineligible for a Platinum SUB. So, you want to look at what the current offers for the Platinum might be - and they are usually MUCH better than the upgrade offer - right now you can find 150K rewards SUBs on the Platinum or more.

With Amex, I’d tend to want to get the new card with the better SUB - and THEN upgrade the other card if that will get me a bunch more points. (You can then decide to close one after the next year’s annual fee posts, or ask for a retention offer to make it worth keeping.)

In general, with Chase: You can only earn a SUB every 24 months on many cards, and every 48 months for the Sapphire cards. (They start counting on the date you earn the bonus, NOT get the card.)

So a lot of the time with Chase, you want to be mapping out opening the card, earning the SUB, deciding to hold, closing and getting the card again with a new SUB when you are eligible.

Last thing: everything I said above is true in generalities - but there are tactics that sometimes make doing upgrades or card type changes valuable.

If I didn’t mention it to you already, a great resource is the 10x Travel course which helps outline a lot of points questions.

**Amex really isn’t once in a lifetime, it is really every 7 years, maybe sooner. There are other scenarios where you can get more cards - they like to send current cardholders offers to get another of the SAME card with “no lifetime language” on the terms. In that case you can get another SUB.

Sears is mostly only in our memories - that’s an old photo from the Internet I stumbled on. ![]()

I think the old management team bought the name and has something Sears-y online, but not sure?

Go Gramps ![]() I’m glad to hear they (Sears) are still kicking. Our local shell of a mall had many stores close including Sears and for some reason I thought it was a general out of business.

I’m glad to hear they (Sears) are still kicking. Our local shell of a mall had many stores close including Sears and for some reason I thought it was a general out of business.

I think most physical locations are, at least in my area I don’t know of any open. They are still online and have paired with some other well known brands that I can’t recall at the moment. My card has just traveled the chain with them. It’s my oldest account. My Gramps added me to his account with my own card and when he passed they gave me a new account, new card but on my credit report it shows as if I’ve had the card for as long as I’ve been on my Gramps’ account. I was only on his account so I could take my Granny shopping. She had early Alzheimer’s for a long time and couldn’t drive or keep credit cards (she’d literally give them away to people asking for money ![]() )

)